Naryan D.

Ft. Lauderdale

“It opened the door to an American Express credit card for my business, which is one of the absolute best business credit cards you could have.”

Hello my name is Naryan and I’m giving a video testimonial for the Business Credit and Finance Suite, which I’m very happy to be a part of. I’ve learned a lot; even having some experience and knowledge in this industry of credit and finance, even an old dog can learn new tricks. This six-step process was wonderful, and going through this, I’m going to tell a little story that happened to me… I wasn’t even sure, I didn’t even realize it was happening. I have an office building, 3,000 square feet, that I could use, but I also have several businesses and having all of them at same location was getting the Dun & Bradstreet, or the DUNS, number co-mingled with two different corporations. So what I did is went ahead, and through the Business Credit and Finance Suite, I used Regus, which is a virtual office. Now I didn’t really need to spend the extra money, but realizing that in this process of credit and true financing of other people’s money, you do need to have your ducks in a row, and part of that is having a correct business mailing address and telephone number. So I went ahead and signed up for Regus. One thing I’ll tell you, this was very easy. Had I done the research, which I didn’t have the time to do anyway, it probably would’ve taken me a day or two to figure out Regus was the one to go with. However, through the Business Credit and Finance Suite, in this step 1 is a simple one- click solution. I clicked on it, and I received an email from a representative through the finance suite and Regus. I sent off an email and little did I know inside of 30 minutes I already had a listed 411 telephone number and a proper business address. That’s not the best part. I kept this address for just over a year, going through the Business Credit and Finance Suite, of course I’m going through the steps of establishing credit and building my profile. What I’ve realized or I guess I didn’t realize is that Regus and American Express at the time had a promotion and anyone who had a Regus account was offered credit with American Express. Now I realize I received this preapproved offer about a year into the game. It wasn’t until about a year and a half after starting the program that I said, “you know, let me go ahead and apply.” When I was approved for the American Express—and it’s not the black card yet, you need to be invited for that one, but it was just below the black card and one of the best that you could possibly have. When I received this offer and realized that because I simply spent a little money for a virtual office that was very much needed, it opened the door to an American Express credit card for my business, which is one of the absolute best business credit cards you could have. So with that said, there is much more I could tell you but I want to keep this as short of a video testimonial as possible, and hopefully I’ll have more to come. Thank you to the staff of the Business Credit Suitethank you to the coaching staff and for all that you do.

Kylon T.

Valencia, CA

“The CCS Finance Suite is the best step-by-step, paint-by-the-numbers system to securing anywhere from $50,000 to $250,000 in business credit.”

Hi there, my name is Kylon, and I’m doing this video just as a quick testimony for the CCS Finance Suite. For anybody that’s thinking about purchasing the CCS Finance Suite for the purpose of either, one, building business credit, or secondly, securing finance for your business: Regardless of if you’re a startup business or you’ve been in business for awhile, what I’ve found is that most businesses simply don’t have business credit, which is really a critical factor when it comes to growing your business and securing capital so that you can continue to grow and expand your enterprise. That being said, I believe that the CCS Finance Suite is the best, really, what I call step-by-step, paint-by-the-number system to securing anywhere from $50 to $250,000 in business credit. When I say business credit, I’m talking specifically credit that reports not on your personal credit report, but on your business credit report, that helps you to separate your personal and business credit. That being said, the system is really slick in that it gives you of all the information that you need in either written form and/or video form. What I like the most is the fact that you have access to actual coaches that will take you by the hand and walk you through the system, answering specific questions that you have related to your business. It’s just an amazing opportunity that most small business owners, I say over 90% of small business owners, just don’t have when it comes to growing their business. So if you’re thinking about it, don’t think about it, just go ahead and make it happen and get started. Like anything, it is a process, but the beginning of any journey starts with one step, so take that step right now. Thanks so much CCS Finance Suite, all of the staff, you guys have been wonderful and we’ll talk to you soon. Bye for now.

Michelle M.

Sacramento, CA

“The Business Suite has been a lifesaver on all levels. I’m going to have the money that I need for the things that I need for my business!”

Hi, I’m Michelle. I’m out of Sacramento, CA. I was sitting here and going through my Business Suite and I was thinking I should say something to them, because this has been a lifesaver on all levels. Just getting my LLC up and running, having advisors there to call when I need them, emailing and them actually emailing me back, that’s fantastic. Anyway, I just wanted to do a testimonial, let you guys know that I do appreciate it. I can’t wait to see all of my results that I’m going to get, I can already see right now it makes a big difference. I know that I am going to be able to grow my business, and I know I’m going to have the money that I need for the things that I need for my business, so that’s wonderful. Anyway, thank you, ty, and to everybody else at the CCS Finance Suite.

James H.

Dallas, TX

“It’s a one-stop shop, puts everything all at my finger tips and allows me to have full control over the success of my business.”

Hi, my name is Jim. I’m the owner of a disability firm. I’m actually recording this video testimony, as you see here, at my home office. I just wanted to do a quick video, because I wanted to inform the populace out there how excited we are about the CCS Finance Suite. For all intents and purposes there is not a lot – and I’ve done plenty of research and I’m sure you probably have as well – on the internet regarding business credit, how to obtain it, what are the one, two, three steps of how to get business credit and secure financing. This is so important for a small business such as mine to be able to survive and thrive in today’s economy. I’m sure that you can agree with that. And so what’s great about it is the fact that you have the support, with the team, the finance suite product is so integral for our business because of the fact that it teaches you how to structure your business properly. There were some things that I was missing, there were some things that I had, but there were some things that I was missing, as well as the credit profiles and things like that to be created and invent the trade lines. We would never know what are the criteria that are necessary, the underwriting guidelines for the vendors to be selective that when we would choose them, that we would be approved versus something where it would negatively impact our credit, because we were just taking a shot in the dark. So I thought that was very, very important and of course, you know, where are you going to find that? No one’s telling you anything about that, right? And then of course to be able to get a business credit card in my business name with no personal guarantee, because most of the time, they want to get your social security number when you’re applying for a business credit card, so this totally separates my personal from my business, which is awesome. And then of course the major thing is securing financing. You know we all need financing and working capital. My business sure does and did at the time, and so it’s awesome. I’m very excited where I’m at today, and I’m very excited about the process. The team is very supportive, they are very knowledgeable about business credit and securing the best financial options for you and they go through everything thoroughly. I can’t say enough about it, but again, because of the fact that it is exclusive, you don’t see this anywhere else on the internet. This puts everything, it’s like a one – stop shop, with everything all at my fingertips. With that being said, it allows me to have control, which is what I like to have, full of control over the success of my business and I’m sure that you would agree. That’s my testimony. Go out and buy your own CCS Finance Suite. Thank you.

Curtis H.

Wilmington, DE

‘’ I have used the CCS Funding Suite myself and I just want to say that it’s been everything it was advertised to be and then some.”

Hello, my name is Curtis, and I am here to give you a testimonial about the CCS Finance and Funding Suite. I have used the CCS Funding Suite myself and I just want to say that it’s been everything it was advertised to be and then some. I’m really not sure where else you can find a program that’s as comprehensive. I will say that it is not for someone who is going to be lazy with it. You’re really going to have to work the program. It’s going to take 9 to 12 months to get you through the entire thing. But once you do go through the funding suite, your business is in a beautiful position to have access to lending and to be setup for what the banks and lenders are really looking for. I think that’s the big value of this program. To me, when you’re trying to get lending, banks just come back and say yes or no. They don’t really tell you why. It’s not like obtaining a mortgage for a home purchase, where they come back and say specifically, “This is why we denied you, if you can correct this and this, then we’re going to do business with you.” In the funding world, it’s almost a mystery. You wonder if the stars are not aligned properly. What this program did, at least for me, is it clarified everything. It walked me through it step by step. Everything from the credibility phase and even while you’re working the program – you know going through the steps, which again take 9 to 12 months – even right from the beginning once you get to the credibility stage it is going to walk me right into a stage that’s called fundability. That’s where it’s going to match me with whatever lenders I can get access to funds from right now. And depending on how long you’ve been in business and some other things you have going for you, you can get access to funds right away if you need them. My interest in the program wasn’t that, my interest was in following it through all the way and really putting my business, credit-wise, in the position where we had a strong D&B, Paydex, and a good overall credit profile. Now, if I need lending, the entity itself really, really looks stellar, not only from a Paydex Score perspective but also all of the other little things that the lenders in the banks look for, extending funding to businesses of my size. I can’t say enough about the program. Again, I did search around before I settled in on this funding program. I tell you what turned me off about other programs is they didn’t really seem to know what was going to work and what wasn’t going to work. It was almost like, “We’ll try this and we’ll match you with this lender and will see if it works.” That’s not this program. This program is very deep, is very well-designed, very well-organized, and I would recommend it to anybody that is seeking to get funding for their business or put their business in a position where they’re credible for funding from lenders. I have recommended it and I will continue to do so. Again, my name is Curtis and it’s been a wonderful addition to my business. Thank you.

Chad C.

Carlsbad, CA

“The CCS Finance Suite has allowed me to establish my company’s corporate credit, expand my business operation, and take my company to the next level.”

Hi, my name is Chad. I’d like to speak on behalf of CCS Finance Suite. The business credit-building process that I engaged in with the CCS Finance Suite has allowed me to establish my company’s corporate credit, expand my business operation, and take my company to the next level. Not only to have options for great funding solutions for my business, but also to prepare myself for the future, so that I can have the best credentials available to obtain the best funding when I really need it. Thanks, CCS Finance Suite.

Cheryl R.

Shreveport, LA

“I believe that CCS Finance Suite has opened up possibilities for my business in the future that I could have never imagined. Every business owner can benefit from CCS Finance Suite.”

My name is Cheryl. I’m located in Shreveport, Louisiana. I was a bank lender in the past and I thought I knew all about the financing and funding options available for businesses. I even went through the bank loan process when I got ready to purchase an existing business. I found out that the process was very tedious, the paperwork required was extensive and it took months to complete the whole process. After that experience, I learned that there are a lot of different funding options available for businesses. But most business owners don’t know how to get the money. I was very excited when I learned about CCS Finance Suite and the process of building business credit for my business where I can get even more money that I could never get before. I believe that CCS Finance Suite has opened up possibilities for my business in the future that I could have never imagined, and that every business owner can benefit from CCS Finance Suite. It will change the way you do business.

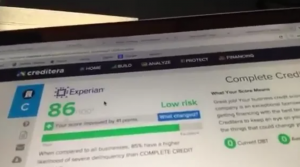

Eric C.

Paragould, AR

“This thing really works. I cannot recommend it more.”

Hi everybody, my name is Eric and I have been using the CCS Finance Suite for quite some time now. I’ve actually had it about a year, and a lot of people will get on here and tell you about how great it is and how amazing the customer service is and all of those things. I just would prefer to show you. So this might look a little weird on the video, but I’m going to just turn my phone around here. That’s what they did for me. Look down here: average national score, how’s that? Guys, this thing really works. I cannot recommend it more. Thanks.

Luis T. and Jennifer R.

Miami, Ft

“My wife purchased the CCS Finance Suite and she was able to establish a business credit profile to apply for business funding without even using her social security number.”

We are located in Miami, Florida. My wife operates a business here in Miami. Recently she was able to purchase the CCS Finance Suite, and it has helped her a lot since she was able to establish a business credit profile. The good thing about having a business credit profile is that she was able to apply for some business funding without even using her social security number. Believe me, if you are a business owner, you need this program. I’m telling you right now, you need this program because it will help you a lot and you’ll stop being personally liable for every credit that you apply for. Thank you very much for listening. Take care.

Business Credit Results

See the actual results of what you can accomplish when building credit for your business that’s not linked to your SSN.

Funding Case Studies

Access funding case studies to see the types of loans we’ve provided to companies like yours, even when banks said “no.”

Testimonials

See what our customers have to say about the business credit and financing results they’ve seen so far.

YOUR INFORMATION IS SAFE

We do not sell or rent your personal contact information for any marketing purposes whatsoever.

SECURE CHECKOUT

All information is encrypted and transmitted without risk by using the Secure Sockets Layer protocol.

NEED HELP?

Toll-Free: (800) 400 2517

Local: (307) 222 0441

Fax: (307) 243 2447

Contact@YourLendingPartner.com

About Salient

The Castle

Unit 345

2500 Castle Dr

Manhattan, NY